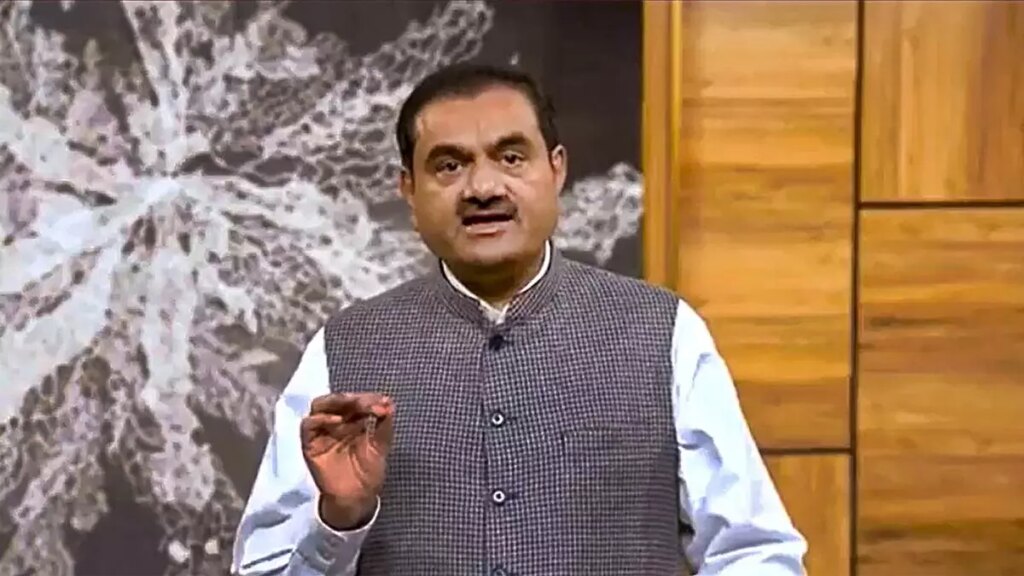

Investigators are digging into whether or not an Adani entity, or individuals linked to the corporate together with Gautam Adani, have been concerned in paying officers in India for beneficial remedy on an power mission, mentioned the individuals, who requested to not be recognized discussing the confidential effort.

The probe, which can also be taking a look at Indian renewable power firm Azure Energy International Ltd., is being dealt with by the US Lawyer’s Workplace for the Japanese District of New York and the Justice Division’s fraud unit in Washington, mentioned individuals conversant in the matter.

“We’re not conscious of any investigation towards our chairman,” Adani Group mentioned in an emailed assertion.

“As a enterprise group that operates with the very best requirements of governance, we’re topic to and absolutely compliant with anti-corruption and anti-bribery legal guidelines in India and different international locations.”

Additionally learn: Adani Group to speculate ₹75,000 crore in Madhya Pradesh

Representatives for the Justice Division in Brooklyn and Washington declined to remark. Azure didn’t reply to requests for remark. Gautam Adani, his firm and Azure haven’t been charged with wrongdoing by the Justice Division, and investigations don’t all the time result in prosecutions.

Along with being a monolithic presence in its house nation, with ports, airports, energy traces and freeway developments, Adani Group attracts capital from all over the world. US legislation permits federal prosecutors to pursue international corruption allegations in the event that they contain sure hyperlinks to American traders or markets.

Adani’s sprawling empire was rocked early final yr by claims from short-seller Hindenburg Analysis that the conglomerate manipulated its inventory value and dedicated accounting fraud. The group has vigorously denied these allegations and the shares have largely climbed again from their preliminary plunge.

Nonetheless, the report prompted the Justice Division, in addition to the Securities and Alternate Fee, to look into a few of the claims, Bloomberg Information reported final yr.

The Adani probe is now at a complicated stage, in accordance with the individuals. The DOJ can select to pursue its investigations with out notifying the events.

Adani Group and Azure compete in India’s green-energy sector, and in recent times each have gained contracts for tasks as a part of the identical state-run photo voltaic program. Adani is looking for to place itself as world-leading renewable-energy firm at a time when Prime Minister Narendra Modi, a perceived shut ally of Gautam Adani, is pushing main inexperienced initiatives.

Azure has been coping with fallout from whistleblower complaints of illicit funds and was delisted from the New York Inventory Alternate late final yr over delayed filings.

Azure mentioned final yr that it was cooperating with the Justice Division and SEC after an inner probe discovered proof that folks beforehand affiliated with the agency might have been conscious, or been concerned in, an “obvious scheme with individuals exterior the Dad or mum to make improper funds in relation to sure tasks.”

FCPA Circumstances

The International Corrupt Practices Act makes it against the law for a corporation or particular person with US hyperlinks — corresponding to a public itemizing, American traders or a three way partnership — to pay or supply one thing of worth to a different authorities’s officers for favorable remedy. Prosecutors in Brooklyn have a historical past of aggressively pursuing these circumstances. Adani Group doesn’t commerce within the US, however it does have American traders.

So-called FCPA investigations can take years, sophisticated by the necessity to collect proof and interview witnesses who could also be exterior the US. The circumstances, nonetheless, are sometimes high-profile and can lead to big fines for firms and large wins for prosecutors.

Officers have more and more sought to convey FCPA circumstances towards executives, though it’s been unusual for the pinnacle of a significant firm to be charged.

Adani Rebound

Gautam Adani, 61, has led the pushback towards earlier claims of impropriety. In a July speech to shareholders, he described Hindenburg Analysis’s allegations as “malicious” and “false narratives.”

After initially cratering on the short-seller’s claims, flagship Adani Enterprises Ltd. shares have gained greater than 70 per cent over the previous yr. Gautam Adani’s fortune has once more surged towards $100 billion, making him the world’s 14th richest particular person, in accordance with Bloomberg Billionaires Index.

India is also now poised to resolve its personal investigations into the agency after the nation’s prime courtroom in January ordered regulators there to conclude their investigation inside three months, and mentioned no extra probes have been wanted. That got here after a committee appointed by that courtroom final yr discovered no regulatory failure nor indicators of value manipulation in Adani Group shares.

From the beginning, the US scrutiny of Adani Group has been laced with geopolitical implications. The corporate is deeply intertwined with the financial system in India, which the White Home has been courting as an ally to counter China. Each Adani and Prime Minister Narendra Modi hail from the western Indian state of Gujarat and have identified one another for years.

The DOJ probe hasn’t stopped Washington from working with Adani Group entities.

Final yr, the US Worldwide Growth Finance Corp. mentioned it could present $553 million in financing to an Adani unit for a port terminal in Sri Lanka’s capital, marking the federal government company’s largest infrastructure funding in Asia, with a purpose of curbing China’s affect within the area.

A senior US official advised Bloomberg Information that earlier than authorizing the mortgage, the federal government discovered Hindenburg’s allegations weren’t relevant to the subsidiary spearheading the Sri Lankan mission.

Extra tales like this can be found on bloomberg.com

#probing #Gautam #Adani #Adani #Group #potential #bribery