Whereas broader market sentiment propelled many shares upwards final week, a choose few firms inside the BSE 500 index exhibited robust efficiency supported by constructive elementary information. Amongst these outperformers, VIP Industries, Kalyan Jewellers, and Latent View Analytics emerged as the highest three gainers.

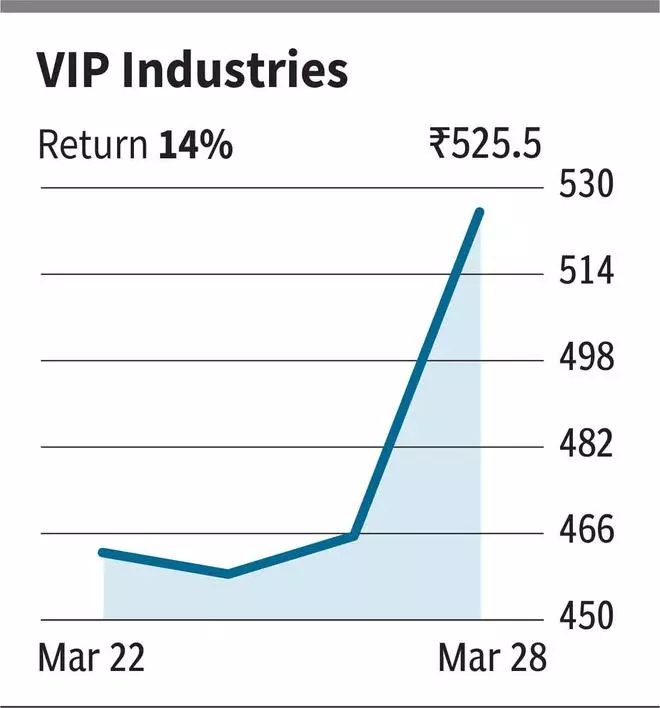

VIP Industries

The inventory of VIP Industries surged 14 per cent over the past week pushed by goal value enhance by few brokerage corporations.

The corporate is a number one producers and suppliers of bags, backpacks, and purses and has been the market chief within the organised baggage section. The Firm has a variety of main manufacturers, positioned throughout your complete value vary, catering to worth (Aristocrat), mid (VIP, Skybags), and premium (Carlton, Caprese) value factors.

The brokerage home Prabhudas Lilladher has raised the goal value of the corporate from ₹589 to ₹603 on expectations of market share acquire and EBITDA margin enchancment. Equally, Centrum Broking revised their scores from ‘Add’ to ‘Purchase’ anticipating the subsequent stage of development hinging on innovation throughout all segments, premium new product growth, provide chain optimization, and omnichannel and e-commerce enlargement.

The inventory is at the moment buying and selling at a trailing P/E of 48.8 instances.

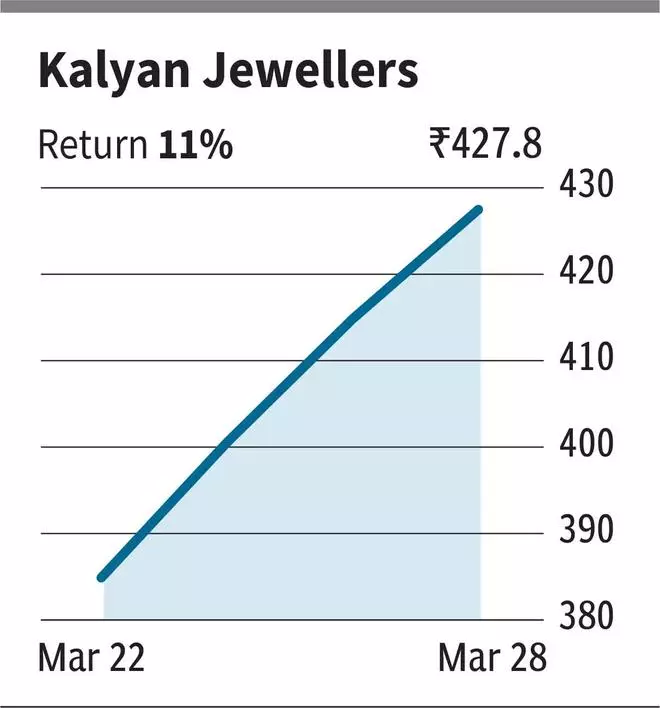

Kalyan Jewellers

The shares of Kalyan Jewellers jumped by 11 per cent final week led by an upward score revision by a credit standing company.

The Firm is engaged in design, manufacture, and promoting a variety of gold, studded and different jewelry merchandise throughout varied value factors starting from jewelry for particular events, similar to weddings to daily-wear jewelry.

Throughout the earlier week, India Rankings & Analysis, a Fitch group firm, upgraded Kalyan Jewellers’s long-term and short-term debt scores to from ‘A/A1’ to ‘A+/A1+’ on account of great enchancment within the consolidated working efficiency and credit score metrics in 9MFY24. The score company expects that the administration plans of divestment of non-core property and conversion of sure company-owned showrooms to franchises, will contribute to the advance in leverage ranges.

The inventory is at the moment buying and selling at a trailing P/E of 101.9 instances.

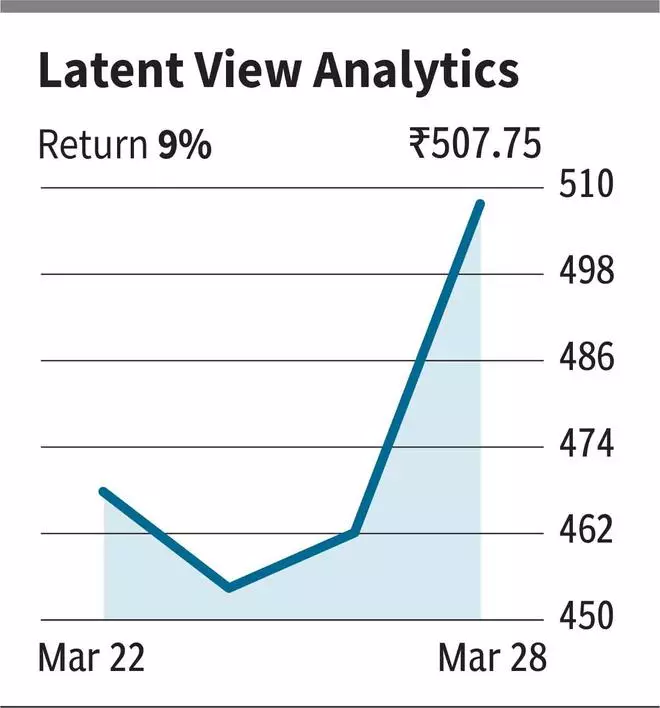

Latent View Analytics

The shares of Chennai-based digital analytics consulting and options agency, Latent View Analytics witnessed a 9 per cent through the earlier week on account of acquisition of Resolution Level Analytics.

The corporate is engaged in providing enterprise intelligence and digital options to assist purchasers mix knowledge and drive digital transformation. They serve varied industries with providers like AI-powered analytics and consulting.

In a press launch this week, the corporate introduced that it’s going to purchase 70 per cent of Resolution Level for $39.1 million. This acquisition is predicted to bolster LatentView’s current experience in knowledge engineering, knowledge science, and knowledge visualization, in addition to consulting and advisory providers for analytics and GenAI readiness.

The inventory is at the moment buying and selling at a trailing P/E of 65.9 instances.

#VIP #Industries #Kalyan #Jewellers #Latent #View #Analytics #shares #outperformed #week #FY24