Quick ahead to September 2024, shareholders are sitting on massive beneficial properties of about 142 per cent from our suggestion. The identify change to Amara Raja Vitality & Mobility appears to have introduced its share of luck too, with the replenish by round 138 per cent for the reason that rechristening in end-September 2023. A re-rating to recognise the efforts within the EV battery house in addition to the sharp rise in value has pushed up the valuation to about 29 instances its trailing earnings now. Nonetheless, the inventory continues to be at a reduction to see Exide Industries, which trades at over 35 instances.

Essentially, prospects look regular in its conventional lead-acid battery enterprise. On the OEM enterprise entrance, whereas gross sales of passenger automobiles have crossed the height and are right into a cyclical downturn, two-wheeler gross sales noticed a late pick-up submit Covid, and therefore, are nonetheless going sturdy. Normally, battery makers derive a great proportion of gross sales and see higher margins within the alternative market, which retains them going when new car gross sales decelerate and Amara Raja will proceed to be a beneficiary of this pattern.

Whereas it holds promise, the brand new power enterprise continues to be in its infancy — nonetheless within the technique of establishing its amenities/infrastructure, expertise tie-ups in addition to signing up prospects. It requires heavy investments and wishes a detailed watch as to how issues form up. The enterprise contributes solely about 4 per cent to whole revenues at the moment.

Lengthy-term traders can proceed to carry the inventory, whereas contemporary exposures needn’t be thought-about at this juncture as a result of run-up in addition to greater valuations now.

Secure footing

Amara Raja earns two-thirds of its revenues from automotive batteries (lead acid) and in that, predominantly from four-wheelers and the alternative markets. After two years of double-digit progress every in FY22 and FY23, new automobile gross sales quantity progress got here down to eight.4 per cent in FY24 and has additional weakened to 1. 8 per cent within the first 4 months of this fiscal. Whereas the corporate provides to nearly all main gamers resembling Maruti Suzuki, Hyundai, Honda, Mahindra & Mahindra and Tata Motors, strong new automobile gross sales submit Covid suggest that the battery alternative demand for these automobiles would maintain the fort within the close to to medium time period, because the cyclical downturn in new car gross sales performs out. The corporate has a 35 per cent market share within the four-wheeler aftermarket.

In addition to, two different components may cushion the downturn in new automobile gross sales to an extent. One, quantity progress in new bike gross sales continues to be within the excessive teenagers into FY25. The corporate has a 25 per cent market share in provides to OEMs. Two, Amara Raja additionally derives rather less than a 3rd of its revenues from provide of business batteries (telecom, house inverter, UPS, railways, and so forth.) the place the cycles and prospects differ from the automotive phase.

Nascent phase

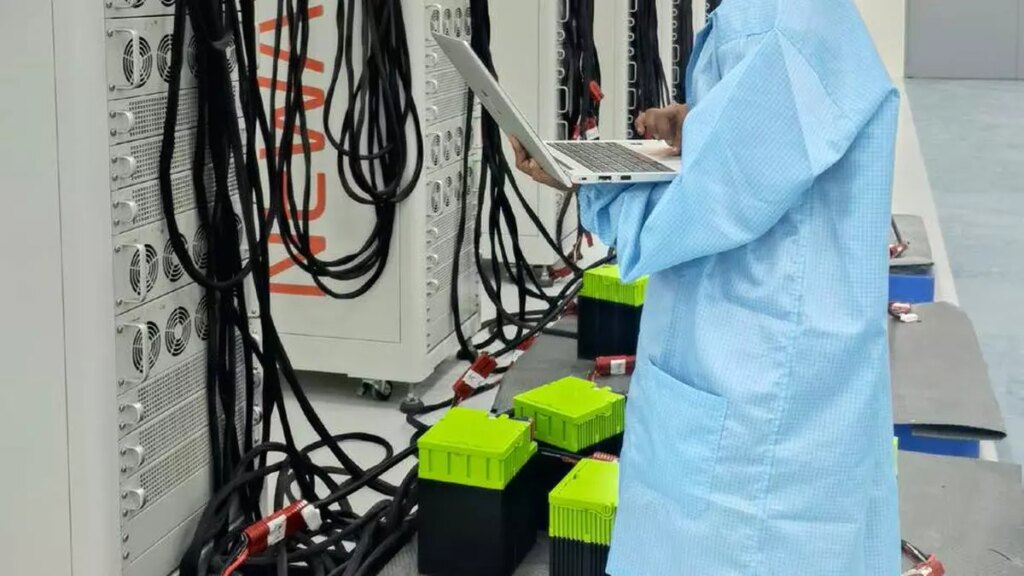

What holds promise over the long-term is its new power enterprise which includes Lithium-ion battery cell and pack manufacturing, EV charging merchandise and power storage options. This enterprise is housed in 100 per cent subsidiaries – Amara Raja Superior Cell Applied sciences and Amara Raja Energy Techniques. Lithium battery packs are at the moment being equipped to 3-wheeler OEMs. The corporate is constructing a brand new pack meeting plant in Telangana to cater to two-wheeler, three-wheeler and business functions. Manufacturing is predicted to start in FY25. It has additionally commenced development of the Cell Giga Manufacturing facility the place an preliminary capability of 2GW in Section I might be scaled as much as 16GW by 2030. The corporate is engaged on each NMC (Nickel Manganese Cobalt) and LFP (Lithium Ferro Phosphate) applied sciences for cells.

For cell expertise, in-house R&D in addition to investments made in a number of tech corporations and expertise tie-ups are anticipated to offer help. The corporate requires heavy investments within the new power enterprise. The administration expects capex within the instant time period at ₹2,000 crore for in home R&D centre in addition to the NMC line (2 GW) for cells. One other ₹2,000-2,500 crore capex is predicted for the LFP line (4-5 GW) within the close to time period. Industrial manufacturing for cells is predicted in the direction of the top of FY26 or FY27.

Piaggio, Mahindra and Mahindra, BSNL and Indus Towers are current purchasers within the new power house. Amara Raja just lately signed up with Ather for provide of cells for two-wheelers, as and when the corporate commences manufacturing.

Segmental margins for this enterprise stood at 5 per cent in Q1FY25.

Financials

In Q1FY25, consolidated internet gross sales moved up 16.7 per cent to ₹3,263 crore and internet earnings, by 25.6 per cent, to ₹249 crore. Working margin got here at 13.4 per cent vs. 13.1 per cent a yr in the past. Though costs of lead, the important thing uncooked materials, has been trending down in current months, the corporate took value hikes in the course of the quarter to go on rise in copper, plastics and different operational prices.

It’s taking a look at a capex requirement of ₹1,000-1,500 crore this fiscal and is planning on elevating short-term debt in the direction of this, to an extent. Lengthy-term debt elevating plans are additionally on playing cards, given the spending necessities within the new power enterprise. Nonetheless, the truth that the corporate just isn’t heavy on debt at the moment lends help.

#Amara #Raja #Vitality #Mobility #Inventory