Prospects proceed to stay sanguine, however valuations have expanded by a bit of over 40 per cent now, in contrast with October 2022 ranges. The inventory now trades at about 34 occasions its trailing 12-month consolidated earnings and about 27 occasions FY25 earnings. Whereas current traders can proceed to carry this small-cap inventory (market cap of ₹3,200 crore), contemplating the run-up in addition to the upper valuations now, recent exposures needn’t be taken at this juncture.

Driving on autos

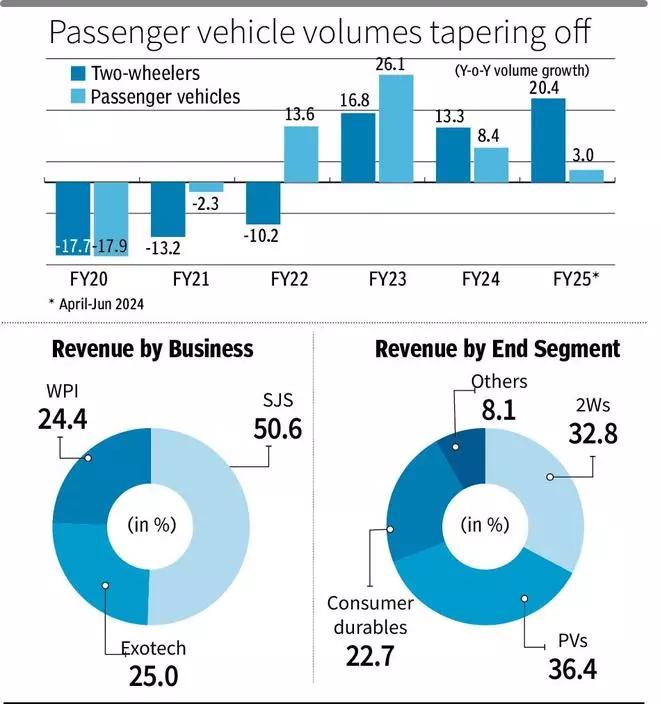

Supplying aesthetic merchandise similar to decals (stickers), appliques/dials, logos, aluminium badges, in-mould decoratives, in addition to optical plastics and lens masks covers predominantly to the auto business, SJS has been using the upturn in home new automobile gross sales submit Covid. Whereas the standalone enterprise is tilted in the direction of two-wheelers (2Ws), by advantage of two acquisitions made in 2021 (Exotech) and 2023 (Walter Pack India or WPI), the standalone enterprise now brings solely half the revenues.

With the acquired companies specializing in passenger autos (PVs), each PVs and 2Ws now deliver a couple of third of the consolidated revenues every. Exotech added chrome plating capabilities to its product line-up. WPI specialises in In-mold decoratives (IMD), labelling (IML) and electronics (IME). SJS counts Suzuki, Bajaj Auto, Royal Enfield, TVS Motors, Honda, Maruti Suzuki, Hyundai and Tata Motors amongst its shoppers within the automotive phase.

The persevering with development of premiumisation — be it the desire for increased cc bikes or SUVs — has been a tailwind for SJS, as these demand increased aesthetics. Through the years, enlargement in product line via the natural and inorganic route has helped the corporate cross-sell merchandise, enhance content material per automobile provided in addition to earn higher margins.

It’s exactly this technique that the corporate plans to deploy as soon as once more because the cyclical upturn in auto gross sales, particularly within the PV phase, has peaked out.

After strong progress in FY22 and FY23, PV quantity progress slowed to excessive single digit in FY24. Into FY25, this has additional tapered off to three per cent progress within the April-June interval. Put up the WPI acquisition, the package worth provided per PV has improved to ₹3,500-5,000, from ₹1,200-1,500 initially. The corporate is aiming for a 3-4x progress in package worth per automobile in future, aided by its give attention to new technology merchandise similar to wheel cap/aluminium badges, IML interiors, optical plastic/contact display screen cowl glass.

Provides to new launches, which can see good volumes whilst offtake of older merchandise slows down, may also stand SJS in good stead. The truth that 2Ws gross sales nonetheless stay strong is sweet information for the corporate. Put collectively (ie 2Ws and PVs mixed), the corporate expects to develop at 1.5 occasions the expansion price of the business, thanks to those elements.

New technology merchandise throughout segments constituted 25 per cent of the consolidated revenues as of Q1FY25. As shows get bigger and bigger, packing in additional components similar to rear-view cameras and infotainment programs, to additional add to the content material per automobile, SJS has entered the quilt glass enterprise (cowl glass for shows) as a tier-2 provider for PVs. This enterprise is anticipated to indicate up considerably within the revenues starting FY26.

What shields SJS from the cyclical nature of the auto business is its publicity to the patron durables house, which fetches 23 per cent of the revenues. It is usually doubling exports income contribution from the present 7.5 per cent ranges.

Sturdy financials

Income from operations got here in at ₹188.6 crore in Q1FY25, 61 per cent increased than the June 2024 quarter, whereas reported earnings grew 57 per cent to ₹28 crore. The expansion figures exclude the influence of WPI integration in Q1FY24. If WPI’s proforma quantity for Q1FY24 are taken, the year-on-year progress comes right down to 23.3 per cent and 14.6 per cent respectively on the high and bottom-line ranges.

EBITDA margins in Q1FY25 got here in at 26.6 per cent, as towards 26.1 per cent a 12 months in the past (27.3 per cent with WPI). Going ahead, nevertheless, the corporate expects to keep up EBITDA margins at round 25 per cent on the consolidated stage because it ramps up new know-how merchandise.

Whereas SJS was freed from long-term debt and was a web money firm in FY23, it took on debt to fund the WPI acquisition (complete consideration of ₹240 crore) in FY24. Nevertheless, it’s again to being a web money firm in Q1FY25.

#SJS #Enterprises #Inventory #RunUp