Quite a bit modified in 2022

First, it’s the power of the greenback. The US Federal Reserve’s aggressive price hikes all by means of 2022 noticed the US Treasury yields surging larger. The US 10 Yr Treasury yields surged from round 1.5 per cent in December 2021 to three.8 per cent by the top of 2022. In consequence, the greenback index skyrocketed 20 per cent to make a twenty-year excessive of 114.78 in September final yr, the degrees final seen 20 years again in Might 2002. Thereafter the index had come off to shut the yr at 103.51, up 8.21 per cent in 2022.

Second, crude oil costs spiking above $100 per barrel weighed on the rupee. The outbreak of the Russia-Ukraine struggle in February took the Brent Crude oil costs to a excessive of $140 per barrel in March. The oil costs continued to hover larger above $100 till June. Oil being the main import element for India, larger costs elevated the nation’s import invoice and, in flip, widened the commerce deficit. India’s month-to-month oil imports elevated from $16.45 billion in December 2021 to $21.5 billion in June 2022. Commerce deficit widened from $21 billion to $24 billion over the identical interval.

Lastly, sturdy overseas cash outflow from the nation was the third issue that triggered the rupee depreciation final yr. Overseas Portfolio Traders (FPIs) had been web sellers of each the debt and fairness phase final yr. The fairness phase noticed a web outflow of about $17 billion and the debt phase about $2 billion. Greenback power, flight to security amidst slowdown fears and relative overvaluation of Indian markets versus different rising and developed market friends, had been the seemingly causes driving the outflows.

2023 – What’s forward

After a unstable yr 2022, the brand new yr 2023 might present some respite for the Indian rupee. Most the of the components that triggered greenback power/rupee weak spot in 2022 are prone to persist within the first half of 2023 as effectively. Nevertheless, since all of the dangers are largely factored out there already, the affect on the rupee might be much less harmful. As such, within the absence of any new occasion threat, the rupee can stage a restoration within the second half of 2023. Right here we check out that components which are for and towards the rupee in 2023.

Components supporting rupee

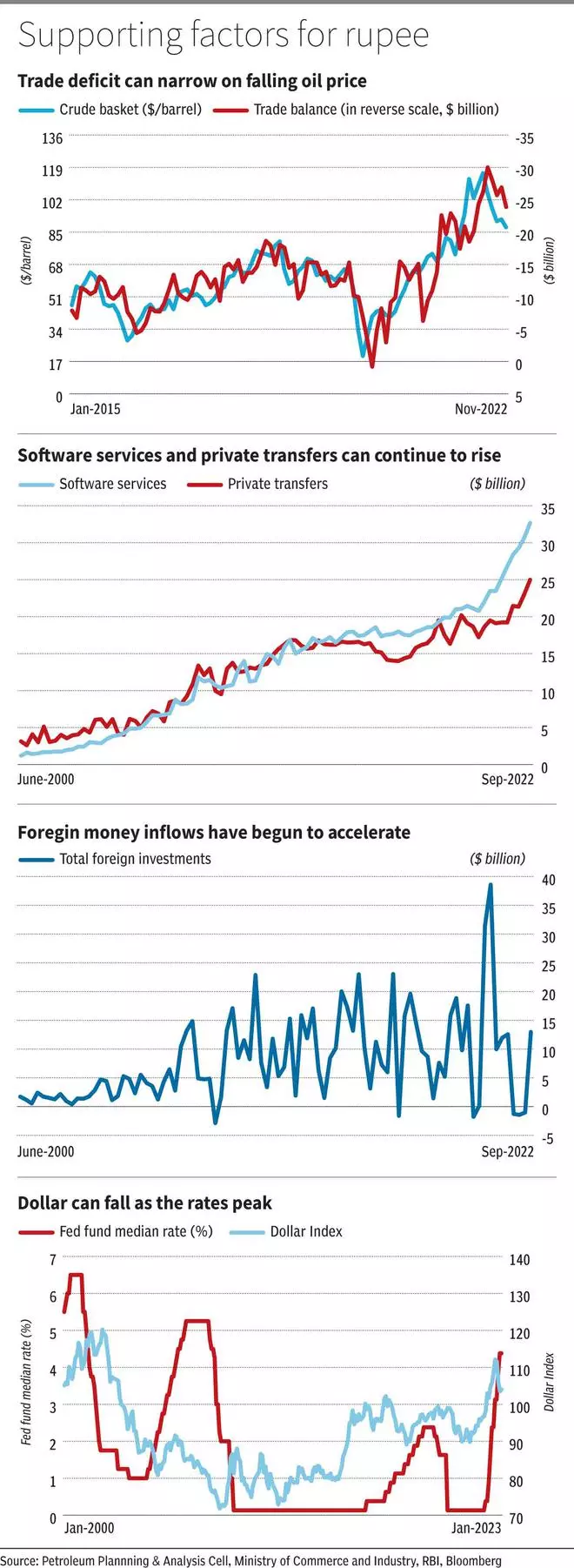

Cooling oil value

Crude oil costs falling and sustaining effectively beneath $100 is a optimistic. This has spelt a major aid of late for the nation’s oil import invoice. On a median, crude oil imports kind about 30 per cent of the nation’s complete imports.

India’s crude basket has come down from a median of $103 per barrel within the first half of 2022 to about $78 per barrel in December 2022. India’s oil imports price stood at $15.74 billion in November 2022, down about 15 per cent from a median of $18.5 billion within the first half of 2022. Nevertheless, the import price continues to be a lot larger than the common of $8.8 billion seen within the calendar yr 2021.

Crude oil costs are prone to stay decrease in 2023 on the again of a doable slowdown within the international economic system. The Worldwide Power Company (IEA) expects the world oil demand to fall by 1.7 million barrels per day (mb/d) in 2023 as in comparison with a rise of two.3 mb/d in 2022. The US Power Data Administration (EIA) tasks the Brent Crude to common round $92 per barrel in 2023.

On the charts, the outlook for Brent Crude oil ($83) is weak. It could actually fall to $70-$65 from right here. The broad vary of commerce for 2023 might be $65-$95.

CAD, BoP can enhance

The autumn in crude value beneath $100 has already aided in narrowing down the merchandise commerce deficit — from round $30 billion in July to $24 billion in November final yr. An additional fall in oil value from right here can see the commerce deficit narrowing much more to about $20 billion within the coming months.

Software program providers exports and personal transfers kind a significant a part of the invisibles element of the present account. Software program providers have elevated from $28.35 billion in December 2021 to $32.68 billion in September 2022. Non-public transfers, however, have gone up from $21.45 billion to $25 billion over the identical interval. Because the rupee continues to stay beneath 80, each software program providers and the personal transfers can proceed to extend additional.

So, a narrowing commerce deficit on the again of low oil costs, coupled with a rise within the invisibles, within the type of software program providers exports and personal transfers, can help in enhancing the Present Account Deficit (CAD) in 2023. As per the latest knowledge launched by the Reserve Financial institution of India, our CAD is at $36.39 billion as of September 2022.

On the Capital Account entrance, the overseas cash flows have began to enhance within the latest months. RBI’s knowledge reveals that the entire overseas investments, that’s the Overseas Direct Funding (FDI) plus the Overseas Portfolio Investments (FPI), have elevated from $1.03 billion in June 2022 to $12.97 billion in September 2022. Latest knowledge from the Nationwide Securities Depository Restricted (NSDL) reveals that there was a web influx of about $5.38 billion from Overseas Portfolio Traders (FPIs) within the final two months of 2022. The Capital Account surplus, which has come right down to $6.92 billion in September from round $28 billion in June final yr, can improve on the again of the improved overseas cash inflows.

Charges to peak

Greenback was pushed in 2022 majorly on the again of aggressive price hikes by the US Fed. The US central financial institution had elevated the charges from 0-0.25 per cent to 4.25-4.5 per cent by the top of 2022. This contains 4 rounds of 75 foundation factors (bps) improve. That is the primary time since 1994 that the US Fed has elevated the charges by 75 bps in a single assembly.

In response to the Fed’s latest financial projections launched in December 2022, the median projection for fund price is forecast to be at 5.1 per cent for 2023. Which means that 2023 will get a cumulative price hike of 75 bps. Thereafter the Fed has projected to chop the charges by 100 bps factors every in 2024 and 2025. Assuming that the Fed sticks to those projections, given the inflation within the US has been giving indicators of cooling down just lately, the rates of interest within the US can peak at 5-5.25 per cent after which begin to come down.

As seen from the chart, it’s evident that the greenback index and the Fed fund charges transfer in tandem. So, the greenback index can transfer up because the Fed hikes the charges by one other 75-bps, presumably within the first half of the yr, after which begin to come down.

From the charts, the greenback index (105.15) has good assist now close to 102. An increase to 108-110 might be seen within the subsequent couple of quarters. Thereafter the greenback index can come down once more in direction of 102 and certainly fall beneath 100.

Components towards rupee

A few components might be unfavourable for the rupee in 2023. We analyse these beneath

Recession worries

One vital occasion as of now which may not have been totally factored out there can be the anticipated recession within the US in 2023 and an general international progress slowdown. The Worldwide Financial Fund (IMF), in October 2022, had projected the worldwide progress to decelerate to 2.7 per cent in 2023 from a projected progress of three.2 per cent in 2022. Throughout recession, the greenback normally good points power. As an illustration, throughout the 2001 dotcom recession the greenback index rose from round 108 in January 2001 to 121 in July 2001. Through the 2008-2009 nice recession, the index rose from a low of 71 to a excessive of round 89. So, if a recession hits the US within the first half of 2023, the greenback index can rise. However thereafter it will possibly begin to fall once more.

Although a recession might affect India additionally, historic knowledge reveals that there have been sturdy overseas cash flows into the nation from the center of the recession they usually lengthen for a protracted interval after the recession ends. Through the 2008-2009 nice recession, the Indian equities noticed an outflow of $12 billion in 2008. Nevertheless, India began to obtain inflows into equities from March 2009, effectively earlier than the recession technically led to June 2009. The FPIs pumped in a whopping $18 billion into Indian equities from March to December 2009. So, the recession, if it comes, could have a adverse affect for a brief span of time.

China opening up

China enjoyable its Covid restrictions have created jitters out there. This has elevated the concern of one other wave of the pandemic. Whereas the affect just isn’t clearly generally known as of now, it’s to be remembered that the markets made a robust and really fast comeback throughout the first wave of the virus unfold. So, assuming the identical, any severe affect from fears of one other wave spreading shall be shortlived.

Reserves build-up

India’s foreign exchange reserves had come down considerably in 2023. From $642 billion in September 2021, the reserves had fallen to $524 billion in October 2022. However thereafter the RBI had begun to construct up its foreign exchange reserves. As of December 23, the foreign exchange reserve is at $562 billion. If the RBI decides to construct up its reserves by intervening within the foreign exchange market because it did in 2021, then the power within the rupee might be restricted.

Our tackle the rupee

Total, we will anticipate the greenback to stay sturdy within the first half of the yr on the again of extra price hikes and recessions fears. This will proceed to maintain the rupee beneath stress within the first half of 2023. Nevertheless, the buck can lose sheen within the second half of 2023. This, coupled with enhancing home macro-economic situations resembling narrowing commerce and present account deficits on the again of low oil costs and enhancing overseas cash flows, will help the rupee to get well within the second half of 2023.

To sum up, the Indian rupee can weaken in direction of 85 towards the greenback within the first half after which get well in direction of 81-80.

Given this, firms with dollar-denominated loans and better imported elements of their enterprise might proceed to face some stress throughout the first half of the yr. These pressures might fade because the yr goes by, until there’s an sudden international shock. Then again, for firms with excessive export earnings, whereas foreign money depreciation, until it continues, ideally ought to be a optimistic, this can be offset by the slowdown in developed economies, which may affect their enterprise.

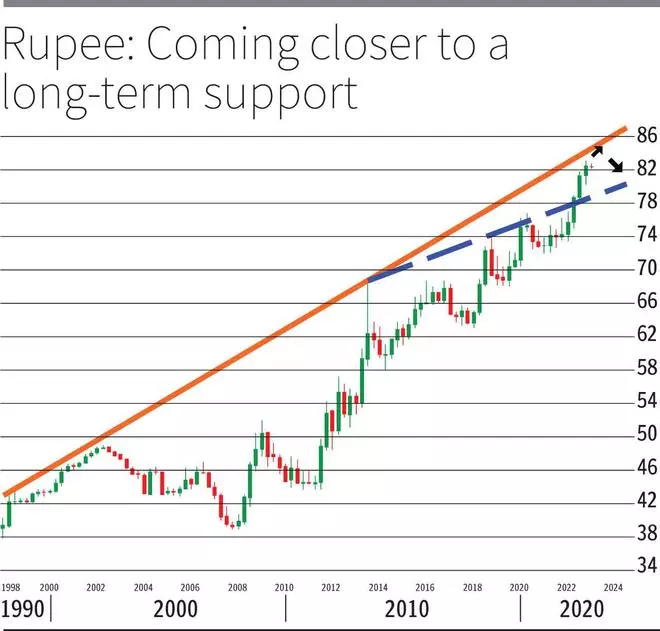

What the charts say

In April final yr when the rupee was round 76 towards the greenback, we had forecast that it might weaken in direction of 80-80.50 by the top of 2022. The autumn has certainly prolonged effectively past our goal and the rupee made a brand new low of 83.29 in October final yr. The home foreign money has recovered from the low and has been broadly range-bound between 80.50 and 83.29 since then. We now analyse the charts to see the place the rupee is headed in 2023.

Supply: MetaStock

Brief-term view: The present consolidation between 80.50 and 83.29 is prone to stay in place atleast for one more month or two. The general downtrend is undamaged and there’s room for fall inside it. Vital short-term resistances are at 81.80, 81.50 and at 81.10-81.00. The possibilities are excessive for the rupee to stay beneath 81 within the quick time period.

We anticipate the rupee to interrupt the 80.50–83.29 vary on the draw back. Such a break beneath 83,29 can take the rupee decrease to 84.80-85 and even 85.25-85.50 within the first half of 2023

Lengthy-term view: The degrees of 84.80-85.00 and 85.25-85.50 talked about above are the 2 main assist zones for the rupee in 2023. We are able to anticipate the home foreign money to bottom-out in both of those assist zones. A powerful bounce-back transfer thereafter can see the rupee recovering in direction of 81.20-81 and even 80 within the second half of 2023. In case the rupee manages to breach 80, the upside can lengthen as much as 79.50-79.30.

An evaluation on the long-term historic motion of the rupee signifies that the restoration from round 85 might need the potential to take the rupee even as much as 78.50-77.50 as effectively. Nevertheless, it’s too early to take a name on this.

So, for now, our most popular path of transfer for the rupee in 2023 shall be to see a fall to 84.80-85.00 or 85.25-85.50 within the first half of the yr. Thereafter the foreign money can get well in direction of 81.20-81 and 80 within the second half of 2023.

#rupee #headed