Even so, we’ve got gold and silver costs rallying sharply within the final couple of months.

If something, the current time is one of the best to strengthen the idea of asset allocation. Certainly, spreading your investments throughout fairness, debt and gold might aid you experience out volatility, cut back portfolio dangers and guarantee a greater return expertise to achieve your objectives. Silver and REIT (actual property funding trusts) could also be different avenues for diversification.

We clarify how totally different asset courses have charted their course over the previous 15-plus years, their dynamics, correlation between their actions and the way an optimum combine ensures draw back safety and cheap long-term returns.

The trajectories of asset courses

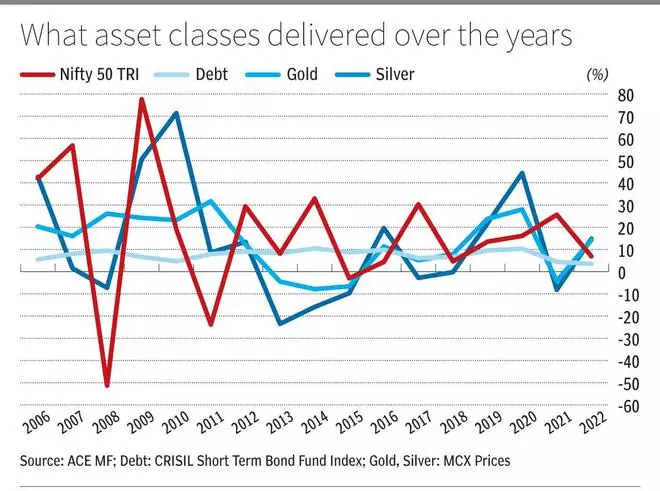

Knowledge taken from calendar 12 months 2006 to 2022 throws up some attention-grabbing sides of how fairness, debt, gold and silver moved through the years. The Nifty TRI is taken to signify fairness, whereas the CRISIL Brief Time period Index is taken to gauge debt efficiency. MCX costs are taken for gold and silver.

Within the raging fairness markets of 2006 and 2007, we had the Nifty delivering 41.9 per cent and 56.8 per cent, respectively. Debt delivered single-digit returns in these years. Gold costs rallied, however not as spectacularly as equities.

Then the worldwide monetary disaster that adopted in 2008 noticed the Nifty appropriate by over 51 per cent. However gold costs rallied a spectacular 26.1 per cent that 12 months.

In 2011, we had the Euro Zone disaster and the Indian fairness market corrected 23.8 per cent. Gold delivered a spectacular 31.7 per cent returns, whereas debt managed rather less than 8 per cent. Within the Covid-19 12 months of 2020, gold gave 28 per cent returns, whereas equities delivered 16.1 per cent returns. In 2021, gold gave detrimental returns, whilst equities continued their sturdy march.

The purpose right here is that asset courses transfer in several paths at totally different cut-off dates. This facet is related for us from the angle of portfolio development and diversification. Extra on that in a bit.

Uncorrelated asset courses

Relying on enterprise and financial cycles, totally different asset class ship returns at varied cut-off dates. Presently, rates of interest are near their peak in India. Inflation is displaying indicators of coming underneath management. India’s macroeconomic parameters are comparatively wholesome and the nation might nicely develop by at the very least 6 per cent, when a lot of the developed markets are probably develop very marginally and even slip right into a recession. Choose bond classes have turn into enticing, equities proceed to be risky and gold costs are on the rise.

Even so, timing the entry into any funding avenue or asset class is difficult, making asset allocation essential. Once we spend money on a portfolio of uncorrelated property, we obtain two key ends. First, we get a well-diversified portfolio and may profit from the features in several asset courses at varied cut-off dates. Second, it reduces volatility significantly in returns and insulates the portfolio from the complete impression of any critical erosion in worth of anyone asset class.

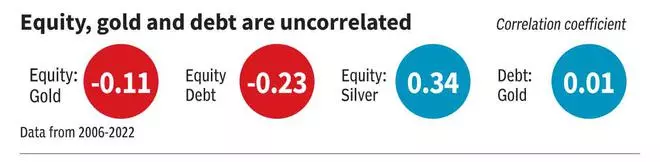

Within the desk, we’ve got the correlation between totally different asset courses. The correlation between fairness and gold in addition to fairness and debt are detrimental. That’s, they typically transfer in reverse instructions. Even the correlation between fairness and silver is simply 0.34, suggesting very low correlation. Fastened earnings and gold have virtually no correlation in one another’s actions. Typically, a correlation coefficient of lower than 0.3 suggests little or no correlation. A price of 0.3-0.5 signifies low correlation between the in contrast variables.

Mixing investments for optimum returns

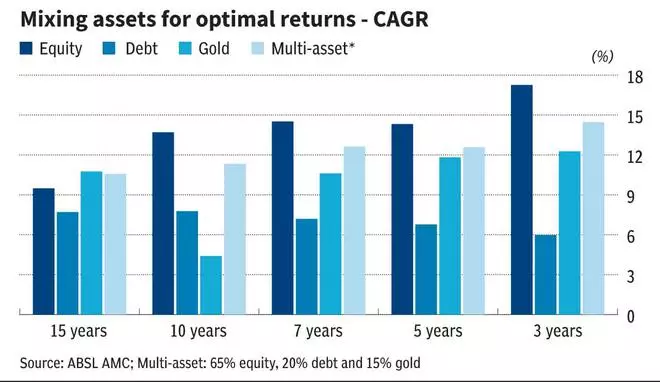

One query that will crop up is why not simply add mounted earnings alone for diversification. You could be aware that an equity-debt portfolio is much less diversified and in addition delivers decrease returns than an equity-debt-gold portfolio.

Knowledge from Baroda BNP Paribas AMC throws mild on having an optimum combine. Three-year rolling returns from 2002 to 2022 have been thought of for Nifty 500 TRI, Nifty Composite Debt Index and gold costs. As well as, a 65:35 equity-debt portfolio and a 65:20:15 equity-debt-gold portfolio have been thought of. The equity-debt portfolio gave greater than 10 per cent returns 67.2 per cent of the occasions, whereas the equity-debt-gold portfolio delivered greater than 10 per cent 71.7 per cent of the occasions. The typical three-year rolling returns over this 20-year interval have been 14.3 per cent for equity-debt, however 15.4 per cent for the equity-debt-gold portfolio.

The desk exhibits the blended returns {that a} multi-asset portfolio would have generated over the previous 15 years and different timeframes. These are CAGR (compounded annual development fee) returns. On this case, the Nifty 50 TRI, gold costs and the CRISIL Brief Time period Bond Fund Index are taken for calculating the blended returns.

Subsequently, a multi-asset portfolio might not ship the very best return, nevertheless it delivers optimum risk-adjusted returns to buyers over the long run. And there’s additionally a greater probability of your blended portfolio struggling detrimental returns over intervals longer than three years.

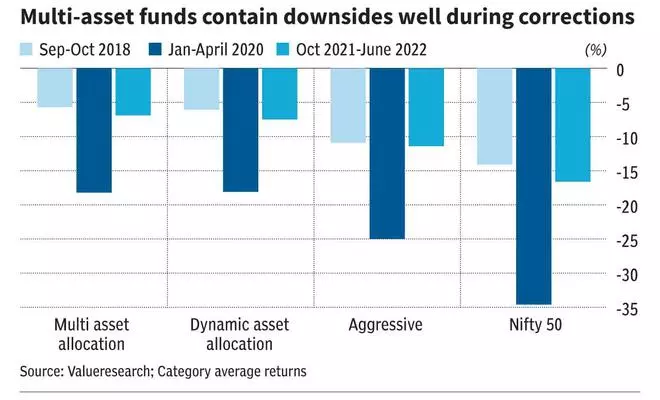

Take the hybrid mutual funds class. Within the final 5 years, it’s the multi-asset schemes which have contained downsides higher than aggressive hybrid or dynamic asset allocation funds that normally have solely an equity-debt combine during times of Nifty 50’s corrections.

Thus, a multi-asset portfolio is a key for optimum long-term returns.

Deciding the allocation

The asset allocation sample to your objectives have to be based mostly in your danger urge for food, time horizon and obtainable surplus. Because the cliched saying goes, there isn’t a ‘one dimension suits all’ system right here.

Typically, in your youthful years, you may have the vast majority of your portfolio in fairness. As you get older and strategy retirement, you need to trim equities and up the investments in debt and gold. Some portion of your portfolio should all the time be in equities even after retirement, so that you just get inflation-beating returns.

Though not a examined and rigorous rule, the ‘100 minus your age’ system to determine the fairness allocation in your portfolio wouldn’t be a foul level to begin off. Typically, every asset class performs a task in your portfolio.

Fairness: It have to be the important thing portion of your portfolio, just because it generates one of the best returns over long-term intervals of 7-10 years or extra. As an asset class, it’s the most suited route for saving in direction of key monetary objectives.

Fastened earnings: Debt supplies diversification and is a supply of secure returns throughout timeframes. It’s splendid for earnings technology.

Gold: Typically, gold is taken into account a great hedge towards inflation. However as seen earlier and from the desk, it turns into clear that gold will be supply of returns as nicely. In actual fact, for seven years (2006-2012) gold delivered double-digit returns yearly. However gold costs are additionally risky — from 2013 to 2015, there have been three years of decline in costs. You may have round 10 per cent of your portfolio in gold.

Silver: Silver is linked to industrial use — electronics, batteries, smartphones, electrical autos and photo voltaic panels, amongst others. As digitisation turns into the norm throughout a number of industries, silver does have the potential to rally, and it certainly has in latest occasions. On condition that its fortune could also be linked with financial exercise, any weak spot might damage. Additionally, the important thing issue to notice is that it may possibly have a chronic bear run in comparison with gold and even fairness markets. From CY2013 to CY2016, silver delivered detrimental returns. Nonetheless, knowledge suggests very low correlation to the motion in fairness markets for the valuable metals. A small portion could also be invested in silver ETFs (lower than 5 per cent)

Traders can assemble an asset allocation sample with portfolio investments in fairness and debt funds, gold ETFs, sovereign gold bonds and silver ETFs.

You can even think about multi-asset allocation mutual funds for getting your funding combine proper.

Most multi-asset funds search to have a 65:20:15 allocation in favour of fairness, debt and gold, respectively. That is completed to get fairness taxation for the investments. Some can also add silver and REITs to the combo. Many funds additionally take secure by-product methods to guard fairness downsides within the portfolio. As they’ve little or no restriction on the mandate to spend money on fairness, debt or gold, fund managers are well-placed to take appropriate calls.

Primarily based on three-year rolling returns over the previous 10 12 months and consistency in efficiency, ICICI Prudential Multi-Asset Fund can be a good selection to your funding. This fund is suited to buyers with a reasonable danger urge for food. The fund has delivered 13.6 per cent returns on a median over three-year rolling intervals throughout January 2013-January 2023. These wanting comparatively decrease fairness publicity however inflation-beating returns can think about HDFC Multi-Asset and SBI Multi Asset Allocation funds.

#multiasset #portfolio #splendid #risky #markets