Because the third-largest mutual fund firm in India by property below administration (AUM), HDFC Asset Administration Firm (HDFC AMC) runs among the largest and oldest schemes.

Sturdy AUM development, steep rise in flows through systematic funding plans (SIPs), wholesome rise in buyer base that sticks on to investments for the long run and increasing market share are positives for the corporate. Trade-leading working margins is one other robust issue.

At ₹3,913, the inventory trades at 36 occasions its possible per share earnings for FY25 and about 30 occasions its anticipated EPS for FY26. These multiples are at par with what Nippon Life AMC trades at, regardless of HDFC AMC’s larger margins and AUM. This makes the inventory engaging from a two-three yr perspective.

Nevertheless, given the 85 per cent rally within the HDFC AMC inventory over the previous one yr, and as fairness markets are at file ranges (and uncomfortable valuations), traders can accumulate the inventory on declines linked to the broader market.

The nonetheless low penetration of mutual funds in India in comparison with most different rising and superior nations, speedy digitisation leading to ease of investments through on-line platforms and the rising incomes and financialisation of financial savings are elements that would give additional thrust on the macro degree for the trade.

The corporate’s working (EBIT) margins have at all times been snug, in extra of 70 per cent (73.5 per cent in FY24). Web revenue margin has additionally remained greater than 65 per cent through the years.

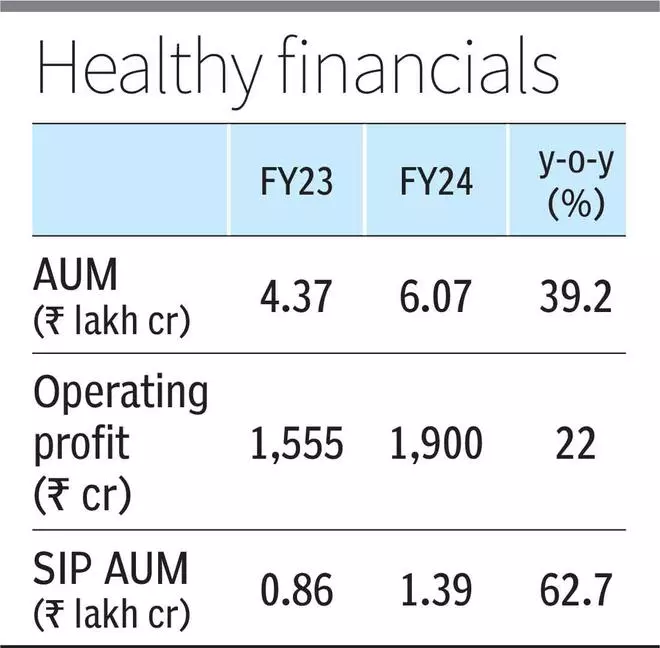

In FY24, HDFC AMC’s revenues rose 19 per cent over FY23 to ₹2,584.4 crore, whereas web income elevated 36 per cent to ₹1,944.2 crore. On condition that different revenue is substantial on account of in-house funding and treasury operations, if the ₹578.1-crore determine is added (₹315.8 crore in FY23), the corporate’s revenues would have risen 27 per cent in FY24.

Sound asset base

Over the previous a number of years, market regulator SEBI has sought to scale back the expense ratios charged by fund homes on their schemes to carry down prices for traders. The ‘telescopic pricing’ methodology of SEBI entails charging decrease expense ratios on schemes as asset dimension will increase.

Since HDFC AMC runs a number of funds with giant asset sizes — three of its fairness schemes have $6.5-billion to over $10-billion AUM — it needed to face the affect of decrease bills it may cost. Nevertheless, regardless of these decrease prices, the corporate managed a yield (income to common AUM) of 47 foundation factors in FY24, simply one-two factors decrease than within the earlier years, because of the general rise in flows into schemes. This yield is the best amongst listed friends and is among the many highest within the trade. The working margin has nonetheless remained secure at 35 foundation factors from FY22 to FY24.

Most of its fairness schemes are inclined to ship sturdy returns and beat customary benchmarks over the long run.

The AMC managed ₹6.07-lakh crore as of March 2024, (up 39.2 per cent yr on yr). Fairness-oriented funds accounted for ₹3.98-lakh crore and grew practically 62 per cent in FY24.

Within the actively equity-oriented funds area, HDFC AMC’s market share by closing AUM as of March 2024 was 12.8 per cent (up from 11.9 per cent) in March 2023. Its debt funds market share too rose and stood at a wholesome 13.4 per cent as of March 2024. Within the liquid funds area, the market share was secure at round 12.7 per cent.

The 63: 22.3: 11 proportion mixture of equity-oriented, debt and liquid schemes, respectively, is larger than the trade’s 54.3: 18.9: 10.8. A better proportion of fairness funds within the combine ensures higher yields and margins.

HDFC AMC’s distinctive traders elevated from 6.6 million in March 2023 to 9.6 million in March 2024, an increase of 45.5 per cent within the final one yr.

The corporate’s systematic transactions base rose to ₹2,930 crore (₹1,710 crore) within the March 2024 quarter.

Additional, HDFC AMC’s SIP AUM stood at ₹1,39,800 crore as of March 2024, up 62.7 per cent yr on yr.

The resilience of the corporate’s SIP e book may be ascertained from how lengthy traders have stayed put. As a lot as 87 per cent of the SIP property stays invested for over 5 years and 80 per cent for greater than 10 years. From an general trade standpoint, just a bit greater than half the fairness property stay invested even for a interval of over two years.

A return on fairness of 29.5 per cent in FY24, up from 24.5 per cent in FY23, is also among the many highest within the trade.

With a secure and skilled fund administration group, wholesome operational metrics and a monitor file of wholesome scheme performances, the HDFC AMC inventory generally is a good play available on the market rally, being among the many most dependable names within the asset administration enterprise.

#Rewarding #Accumulate #Mutual #Fund #Firm