Motilal Oswal Monetary Providers (MOFS) is one such well-entrenched agency that operates throughout the capital market ambit with a strong observe file.

The corporate is a full-service brokerage, and is into funding banking, institutional equities, mutual funds, various funding funds (AIFs) and portfolio administration providers (PMS), and even housing finance.

With₹3.8 trillion in property beneath recommendation as of March 2024, MOFS is a big participant within the trade.

A diversified income combine with a number of rising divisions, regular improve in market share in companies and a wholesome treasury guide are positives for the corporate.

At ₹2,151, the inventory trades at a bit of over 13.3 occasions its per share earnings for FY24 and about 11 occasions its possible EPS for FY25. Even when we exclude treasury funding earnings from the general web earnings of the corporate, the PE a number of for FY24 could be 16 occasions, and for FY25, it’s more likely to be 13 occasions. On a value to guide foundation the multiples for 3.6 occasions FY24 numbers and a pair of.8 occasions the possible FY25 figures.

At these valuations, MOFS trades at lower than most wealth administration and mutual fund friends.

Being deeply linked to the market dynamics, monetary providers shares might be fairly risky throughout stiff corrections.

Due to this fact, buyers with a medium to excessive threat urge for food can purchase the inventory with a minimum of a 2-3-year perspective.

On condition that the share value has risen practically 268 per cent within the final one 12 months, buyers can purchase the inventory in small heaps on declines linked to the broader market.

In FY24, the corporate’s revenues grew 33 per cent over FY23 to ₹5,075 crore, whereas web earnings rose 162 per cent to ₹2,441 crore over the identical interval.

The corporate has typically been capable of ship greater than 50 per cent in revenue earlier than tax margin over the previous a number of quarters.

A number of drivers

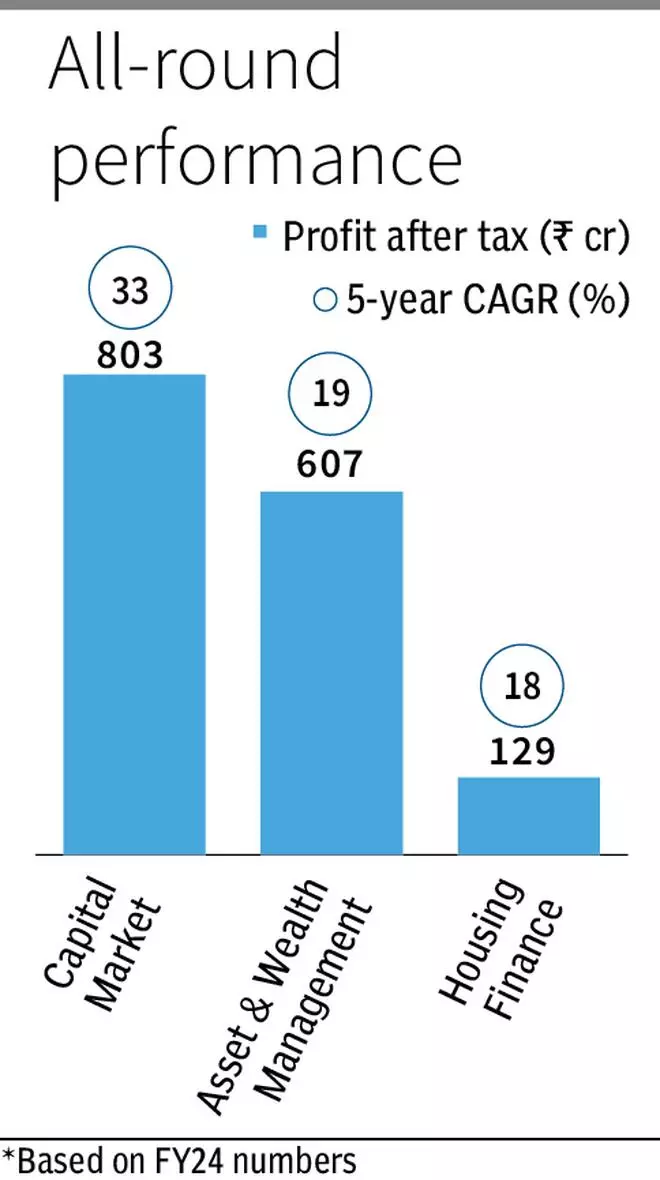

The capital market division of Motilal Oswal Monetary Providers hosts many segments – brokerage, distribution, and funding banking. This division generates 60 per cent of the corporate’s revenues, with brokerage garnering a bit of over 39 per cent of the agency’s revenues in FY24.

It’s among the many high 10 brokerages within the nation with an 8.2 per cent market share as of March 2024 (up from 5.1 per cent in March 2023) within the retail money section and eight.7 per cent share (up from 6.5 per cent in March 2023) within the futures and choices premium market. Amidst aggressive depth within the brokerage enterprise the place low cost brokers abound,MOFS has nonetheless managed to achieve market share, indicating a good diploma of buyer stickiness.

Its depository participant AUM grew at 48 per cent yearly from March 2020 to ₹2.26 trillion by March 2024. The common every day turnover rose at 122 per cent yearly from FY20 to ₹5.5 trillion by FY24.

Curiously, even the distribution section has risen sharply at 38 per cent yearly, from ₹9,034 crore in FY20 to ₹27,038 crore in FY24.

General, the revenues from the capital market division grew 37 per cent in FY24 over FY23.

From a macro trade standpoint, from FY14 to FY24, the entire variety of money and F&O trades within the NSE have risen in each fiscal in comparison with the earlier 12 months, barring FY17. And demat account openings have skyrocketed within the final 5 years.

It’s clear that there’s a sure visibility in income for firms resembling MOFS even when markets aren’t very conducive as commerce volumes proceed to pile up.

Different divisions thrive

The corporate’s asset and wealth administration division, too, has been thriving and increasing quickly.

MOFS focuses on the excessive web price people (₹5 crore to ₹25 crore web price) and extremely excessive web price people (greater than ₹25 crore) in its wealth administration division. It additionally homes the personal consumer group.

The wealth administration section has seen its AUM rise 72 per cent YoY over March 2023 and is at round ₹1.24 trillion as of March ‘24. Since charges and costs are a lot larger on this division in comparison with typical retail merchandise, the yields are strong for the corporate.

Within the mutual fund section, AUM has elevated 57 per cent YoY and stood at ₹71, 810 crore as of March 2024. SIP market share has risen from 1 per cent in FY23 to 1.5 per cent in FY24. Whole mutual fund folios have risen practically three-fold, from ₹10.4 lakh in March 2020 to ₹29.6 lakh in March 2024.

Taking the corporate’s AIF, PMS and mutual fund methods, 95 per cent by AUM have outperformed their respective benchmarks.

Non-public fairness and actual property funds have additionally performed fairly properly for MOFS.

The corporate has a strong treasury funding guide price ₹6,113 crore as of March 2024. It has grown at 25 per cent yearly within the final 4 years from FY20. The XIRR is at a wholesome 18.3 per cent.

MOFS additionally has a housing finance division with an AUM of ₹4,047 crore as of FY24. Progress has been reasonable right here. However asset high quality has improved as gross NPA is simply 0.9 per cent, whereas web NPA is 0.4 per cent as of FY24. Yield, web curiosity margin and capital adequacy stay wholesome.

#Asset #Wealth #Administration #Firm #Funding #Worthy