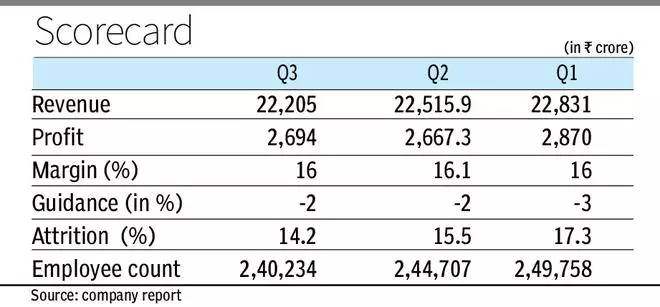

On a quarter-on-quarter (q-o-q) foundation, earnings have been up 1.8 per cent. Income from operations stood at ₹22,205 crore, a 4.4 per cent y-o-y decline and 1.4 per cent sequential decline. The reported numbers have been largely according to market expectations.

The corporate continued to see softness largely within the BFSI, vitality and utilities facet of the enterprise, thus leading to income decline. Thierry Delaporte, CEO and Managing Director, mentioned: “The demand atmosphere nonetheless stays cautious. Shoppers are nonetheless making conservative investments, searching for effectivity, extra returns on investments, and higher optimisation for present investments.”

Outlook improves

Wipro’s outlook for the quarter forward has improved. It has revised its sequential steerage to -1.5 to 0.5 per cent from -3.5 to -1.5 per cent final quarter. Delaporte famous that the corporate is seeing inexperienced shoots available in the market with the panorama evolving, and that is more likely to end result within the transition to income stabilisation from deceleration.

Whilst the corporate continues to obtain criticism for the weak point in its consulting enterprise and underperformance of its acquisitions, the CEO remained optimistic that when the market adjustments for higher, the consulting enterprise would be the first to bounce again. “We’ve got had a very good efficiency from our consulting enterprise with Capco reporting a double digit sequential development so as reserving, the best within the final 4 quarters,” mentioned Delaporte.

The full bookings stood at $3.8 billion, nearly the identical as final quarter. Giant deal bookings have been $0.9 billion, marginally decrease than 1.3 billion final quarter. Margins remained flattish sequentially at 16 per cent. Delaporte famous that Wipro, throughout the board, particularly within the APMEA market, has lowered low margin accounts whereas slowly transferring in the direction of greater worth transformation tasks.

Aparna C Iyer, Chief Monetary Officer, mentioned: “Our margins have remained resilient as we executed on maximizing income efficiency, realizing financial savings and lowering discretionary spends.” The corporate expects to remain vary certain. Additional, because the market improves on the again of transformation and effectivity performs, margin enhancements will be anticipated in coming quarters.

Attrition this quarter additional moderated to 14.2 per cent from 15.5 per cent final quarter. Headcount in Q2 lowered by 4473 workers from 2,44,707 final quarter to 240234 this quarter. Responding to the outlook for more energizing hiring, Saurabh Govil, Chief Human Assets Officer, mentioned, “now we have a expertise pool accessible inside and folks whom now we have provided. As demand is available in, we are going to dip in each accessible useful resource swimming pools.”

Commenting on its current lawsuit on ex-CFO Jatin Dalal, the corporate mentioned that it’s not in opposition to expertise aspiring and assembly their profession targets, however is a matter of complying with contractual obligations.

#Wipro #internet #yoy #poor #demand