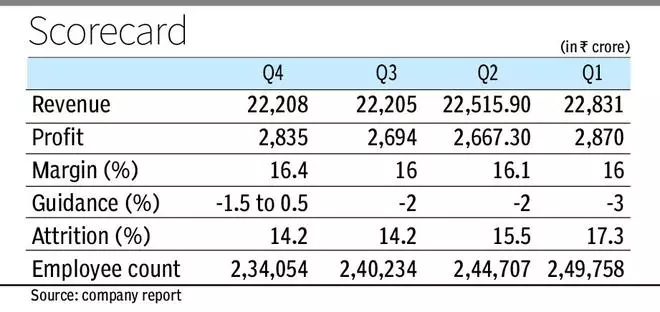

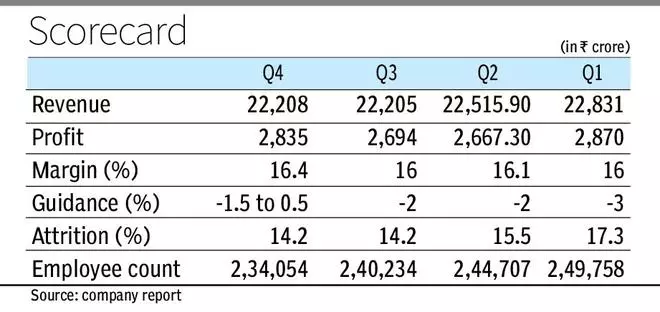

On a quarter-on-quarter (q-o-q) foundation, earnings have been up 5.2 per cent. Income from operations stood at ₹22,208 crore, registering flat progress on a sequential foundation, and 4 per cent YoY decline.

The reported numbers have been largely in keeping with market expectations. Additional, Wipro maintains a modest outlook. The steerage for the primary quarter of FY25 is -1.5 to 0.5 per cent.

Focus areas

The brand new CEO & MD Srini Pallia mentioned the financial atmosphere continues to be unsure and there is likely to be extra challenges within the brief time period. Going ahead the corporate could have 5 key focus areas.

“We are going to think about revitalising the corporate, speed up massive deal progress momentum by working intently with shoppers and companions, strengthen relationships with massive shoppers and companions and additional spend money on accounts which have potential to develop into massive accounts. Deal with trade particular providing and enterprise options led by consulting and inclusive AI, and proceed to simplify our working mannequin and give attention to execution rigor with velocity,” he mentioned.

Wipro underscored that the greenshoots it noticed within the consulting enterprise final quarter, noticed continued traction in This autumn. Capco’s (its greatest acquisition) sequential income, the corporate mentioned, grew by 6.6 per cent and order reserving grew by 43.6 per cent.

Additionally learn: Infosys This autumn outcomes: Are analysts not studying classes or is the corporate faltering?

The whole bookings stood at $3.6 billion, marginally decrease than $3.8 billion signed final quarter. Giant deal bookings stood at $1.2 billion, increased than $0.9 billion final quarter. Margins have improved by a tad, from 16 per cent final quarter to 16.4 per cent in This autumn.

The corporate expects margin to be range-bound within the brief time period. Aparna C Iyer, Chief Monetary Officer, mentioned, “The 17 per cent margin degree is definitely an aspirational degree we nonetheless maintain. We’ve got made a journey from 16.1 per cent to 16.4 per cent, to this point. We additionally must spend money on progress. For us to meaningfully enhance our margins we should additionally see an enchancment of the income trajectory so these are the elements at play.”

Headcount down

Attrition this quarter remained at 14.2 per cent Headcount in This autumn lowered by 6,180 workers from 2,40,234 final quarter to 234054 this quarter. Saurabh Govil, Chief Human Sources Officer, mentioned, “We’ve got been in a position to considerably enhance utilization, it’s at an all-time excessive and I hope to enhance on this. We’re nonetheless to complete all of the affords made beforehand in the course of the Covid instances, earlier than we go forward to rent additional. We are going to induct freshers this yr, however there isn’t a set goal.”

Additionally learn: At Wipro, Srini has a mountain to climb

Dhruv Mudaraddi, Analysis Analyst, StoxBox, mentioned, “Wipro has been gradual in ramping up offers and changing them to income, which the corporate received within the earlier quarters and challenges in worker retention and satisfaction are an enormous a part of it. The steerage makes us cautious concerning the restoration of the corporate’s progress and the general demand atmosphere. The brand new CEO has in entrance of him a mountain of uncertainties which we anticipate received’t be simple to climb no less than till Q2FY25 after we anticipate the discretionary spending to select up.”

(With inputs from bl intern Vidushi Nautiyal)

#Wipro #data #YoY #revenue #decline #crore #weak #demand