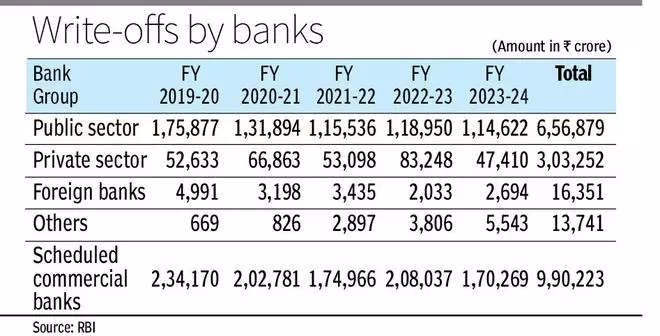

Information additionally defined that, barring FY23, all 4 years witnessed a decline. Although no official clarification has been given for the decline within the write-offs, it’s believed that higher monitoring of uncertain accounts, higher restoration, and a discount in non-performing property are key causes behind it. Final December, the federal government knowledgeable Parliament that, towards an combination mortgage write-off of ₹10.42 lakh crore, PSBs recovered ₹1.61 lakh crore from written-off loans from monetary 12 months 2014-15 until 2022-23. Figures for restoration below write-offs for FY24 haven’t been made obtainable to date.

- Additionally learn: GNPA ratio of scheduled industrial banks projected to enhance to 2.1-2.4 laptop by FY25 finish: CareEdge

As per the Reserve Financial institution of India (RBI) tips and coverage authorized by financial institution boards, NPAs, together with these in respect of which full provisioning has been made on completion of 4 years, are faraway from the stability sheet of the financial institution involved by the use of write-off. The federal government has all the time maintained that write-offs don’t lead to a waiver of liabilities of debtors to repay. The method of restoration of dues from the borrower in written-off mortgage accounts continues.

Additional, banks proceed to pursue restoration actions initiated in written-off accounts via numerous restoration mechanisms. These mechanisms embrace submitting of civil fits or circumstances in Money owed Restoration Tribunals, motion below the Securitisation and Reconstruction of Monetary Belongings and Enforcement of Safety Curiosity Act, 2002, submitting of circumstances within the Nationwide Firm Legislation Tribunal below the Insolvency and Chapter Code, 2016, negotiated settlement/compromise, and sale of non-performing property.

- Additionally learn: Scheduled industrial banks accounted for a bit of cyber incidents from Jan 2019 to Mar 2024

Write-offs additionally assist banks in liberating up capital for additional disbursement. The cash that was put aside by the financial institution for a mortgage write-off is freed up for provisioning different loans. A sure proportion of the mortgage quantity is put aside by the banks for provisioning a mortgage. A minimal of 5 per cent to a most of 20 per cent is the usual price of provisioning for loans in Indian banks, relying on the enterprise sector and the reimbursement capability of the borrower. 100 per cent provisioning is required in accordance with the Basel-III norms within the case of non-performing property.

In the meantime, knowledge additionally confirmed that write-offs by scheduled industrial banks when it comes to loans to ‘Giant Industries and Companies’ recorded a decline in all however one of many final 5 years. The quantity was ₹1.59 lakh crore in FY20, however in FY22, round ₹70,000 crore was written off. FY23 noticed an increase to over ₹1 lakh crore, however in FY24, the written off quantity was round ₹71,000 crore.

#Writeoffs #scheduled #industrial #banks #decline #years